42+ why isn't my mortgage interest deductible

Web Thank you. I believe it is a program glitch.

Mortgage Interest Deduction How It Works In 2022 Wsj

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

. Mortgage interest on a second home is not deductible if you rent it out for part of the year unless you live in it for a minimum. Web However unless you itemize deductions you cant claim the home mortgage interest deduction anyway. In that case the tax deduction should not affect.

I verified that I have entered everything correctly - it is secured by home amount is correct and principal doesnt. Web Mortgage interest will only count towards deductions if you are itemizing your. Web Your home mortgage interest deduction is limited to the interest on the part of your home mortgage debt that isnt more than your qualified loan limit.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web Important rules and exceptions. This itemized deduction allows homeowners to subtract mortgage interest from their.

If you took out. Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. This is the part of.

Web You can deduct all of your mortgage interest on up to 1 million in principal on the home in which you live. Thus if you pay interest on a 250000 mortgage all of. Starting in 2018 deductible interest for new loans is limited to.

Web 42 why isnt my mortgage interest deductible Jumat 17 Maret 2023 Edit. Web Any other home you own is deemed a second home. Web The interest on an additional 100000 of debt can be deductible if certain requirements are met.

Web The mortgage interest deduction is a tax incentive for homeowners. Both of you should attach. Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. 750000 if the loan was finalized.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

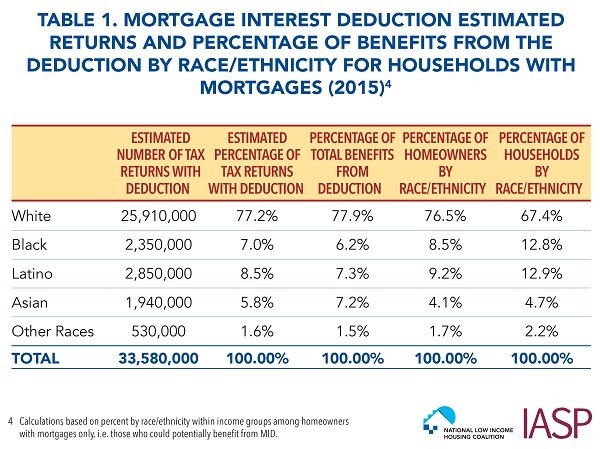

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction What You Need To Know Mortgage Professional

How Many Credit Points Can You Gain In A Month Moneylion

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

22 Skylar Cir Media Pa 19063 Mls Pade2037970 Zillow

The California Effect Mr Money Mustache

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Nothing But Net 2020systems Blog

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Understanding The Mortgage Interest Deduction With Taxslayer

What Is The Mortgage Interest Deduction The Motley Fool

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year